Keresés

Statisztikák

HVCA Statisztikák 2023

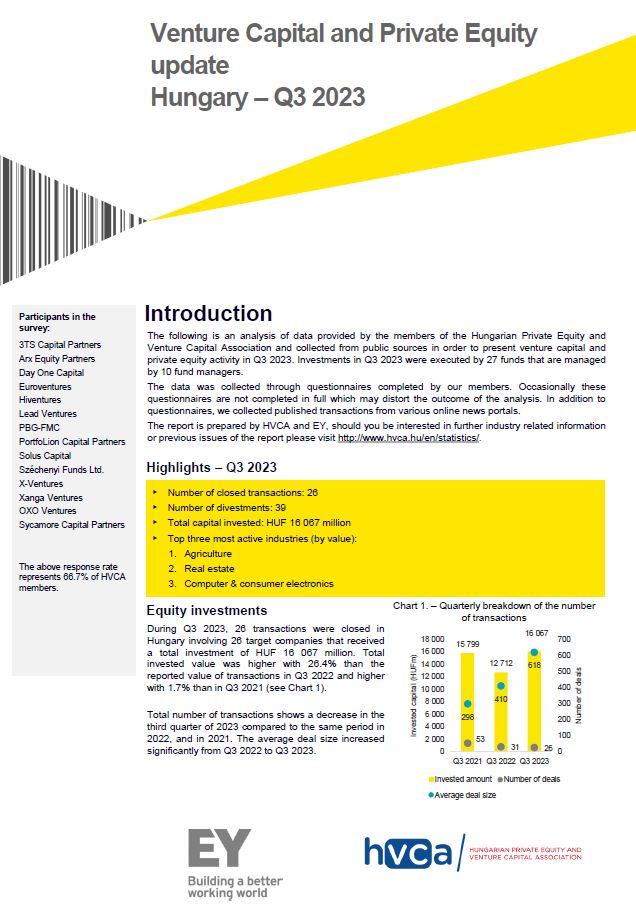

HVCA Investment Monitoring Report Q3 2023

(287KB | pdf)Highlights:

Number of transactions:26

Number of divestments: 39

Total capital invested: HUF 16 067 million

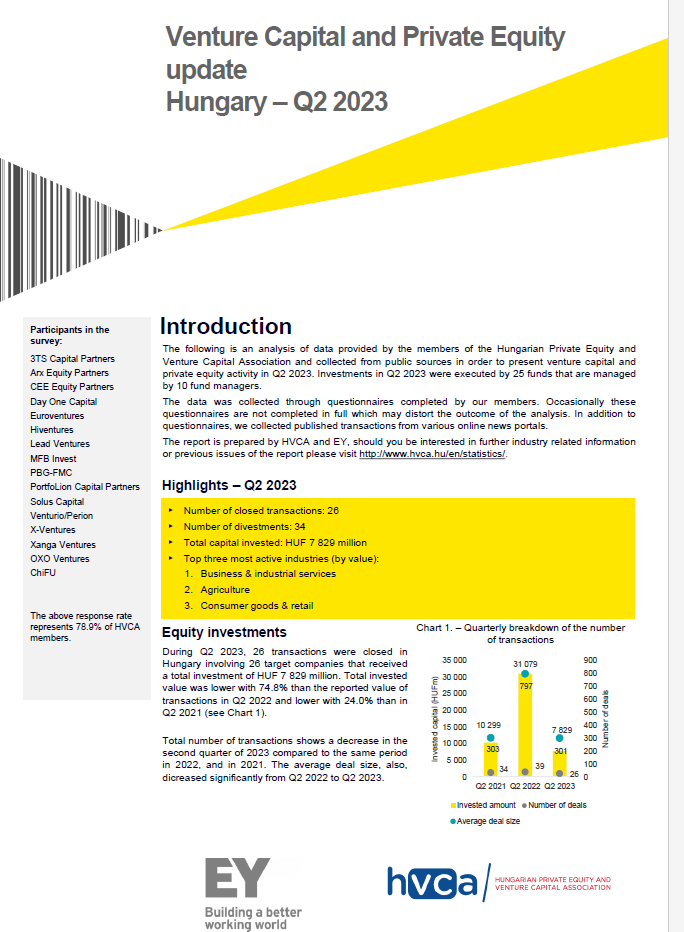

HVCA Investment Monitoring Report Q2 2023

(285KB | pdf)Number of closed transactions: 26

Number of divestments: 34

Total capital invested: HUF 7 829 million

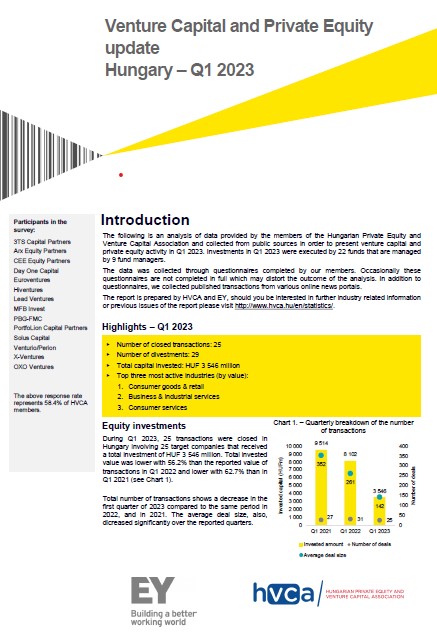

HVCA Investment Monitoring Report Q1 2023

(309KB | pdf)Higlights:

Number of trnasactions: 25

Number of divestments: 29

Totalcapital invested: HUF 3546 million

Top three most active industries (by value):

1) Consumer Goods & Retail

2) Business & Industrial Services

3) Consumer Services

HVCA Statisztikák 2022

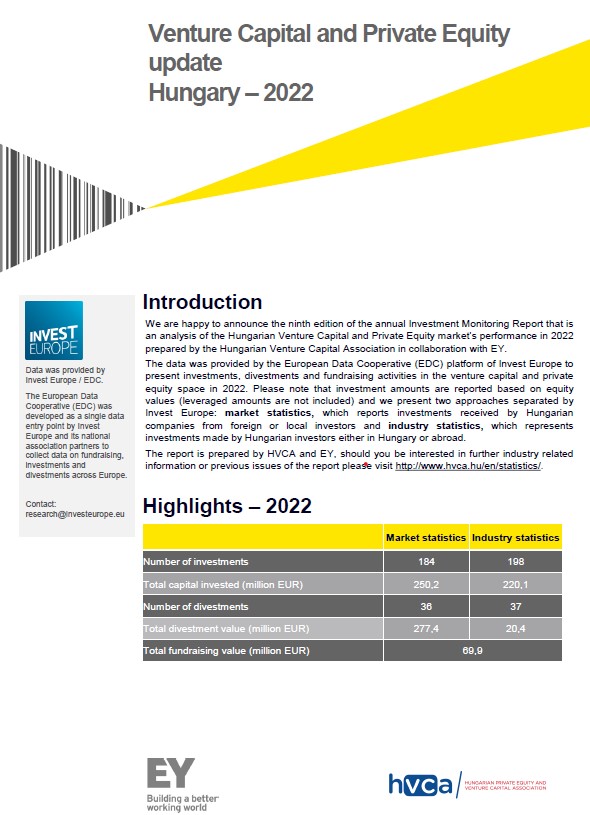

Investment Monitoring Report FY 2022

(426KB | pdf)Highlights:

Number of Investments: 184

Total Capital Invested: 250,2 (million EUR)

Number of Divestments: 36

Total Divestments Value: 277,4 (million EUR)

Total Fundraising Value: 69,9 (million EUR)

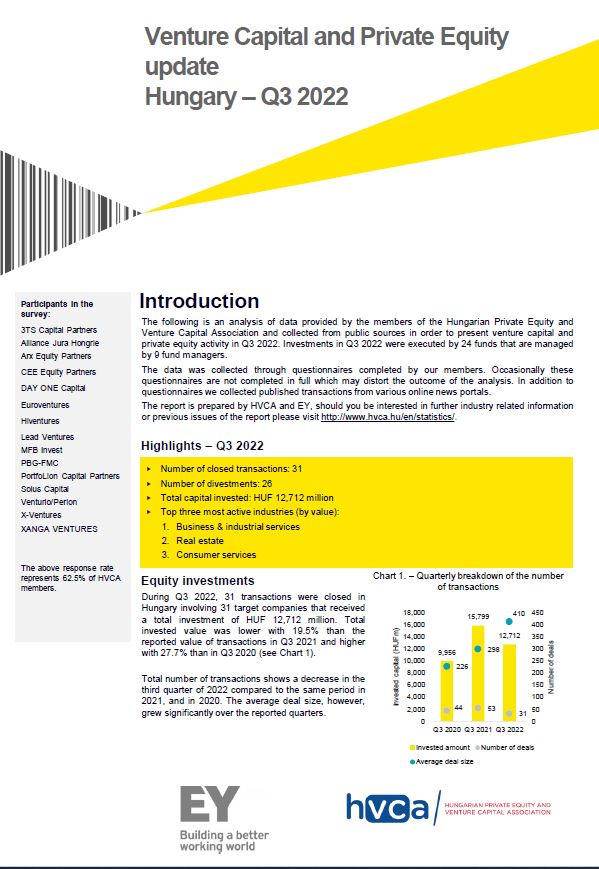

Investment Monitoring Report Q3 2022

(299KB | pdf)Highlights Q3 2022

Number of closed transactions 31

• Number of divestments 26

•Total capital invested HUF 12 712 million

•Top three most active industries (by value)

1. Business industrial services

2. Real estate

3. Consumer services

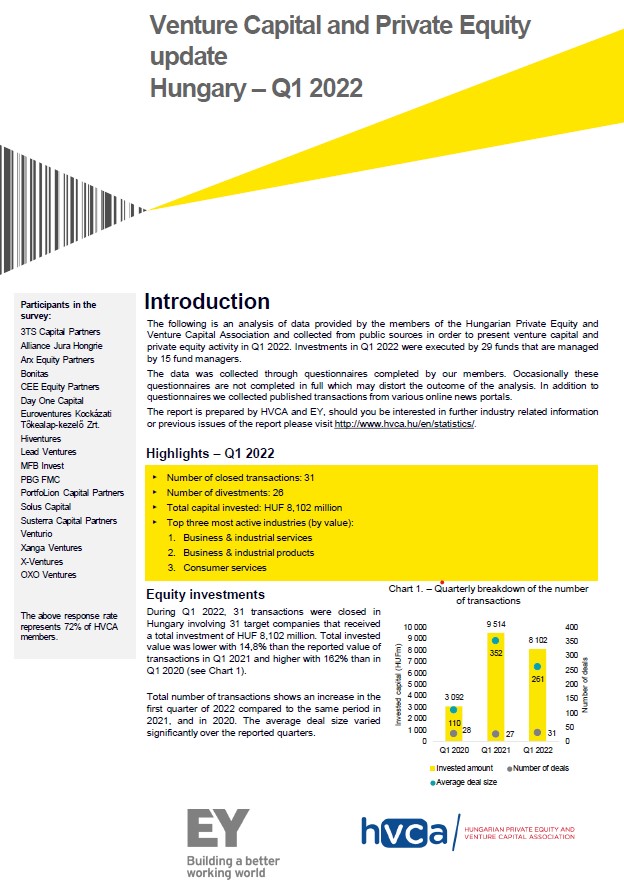

Investment Monitoring Report Q1 2022

(279KB | pdf)Higlights Q1 2022

Number of closed transactions: 31

Number of divestments: 26

Total capital invested: HUF 8.102 Million

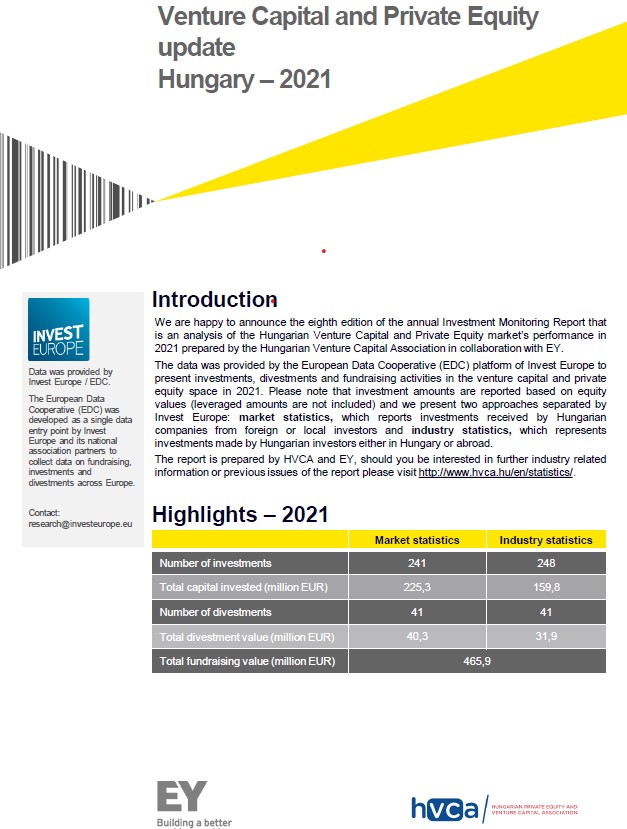

HVCA Statisztikák 2021

Investment Monitoring Riport FY2021

(526KB | pdf)Highlights 2021 (Market statistics)

Number of investments: 241

Total capital invested (million EUR): 225.03

Number of divestments: 41

Total divestments value (million EUR): 40.3

Total fundraising value (million EUR):465.9

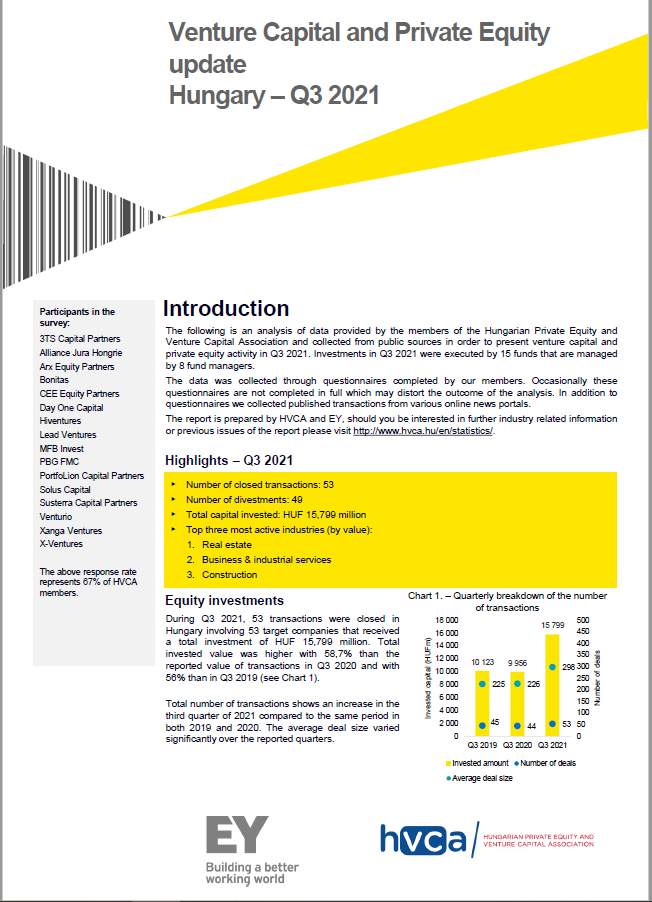

Investment Monitoring report Q3 2021

(304KB | pdf)Highlights -Q3 2021

Number of closed transactions: 53

Number of divestments: 49

Total capital invested: HUF 15,799 million

Top three most active industries (by value):

1. Real estate

2. Business & industrial services

3. Construction

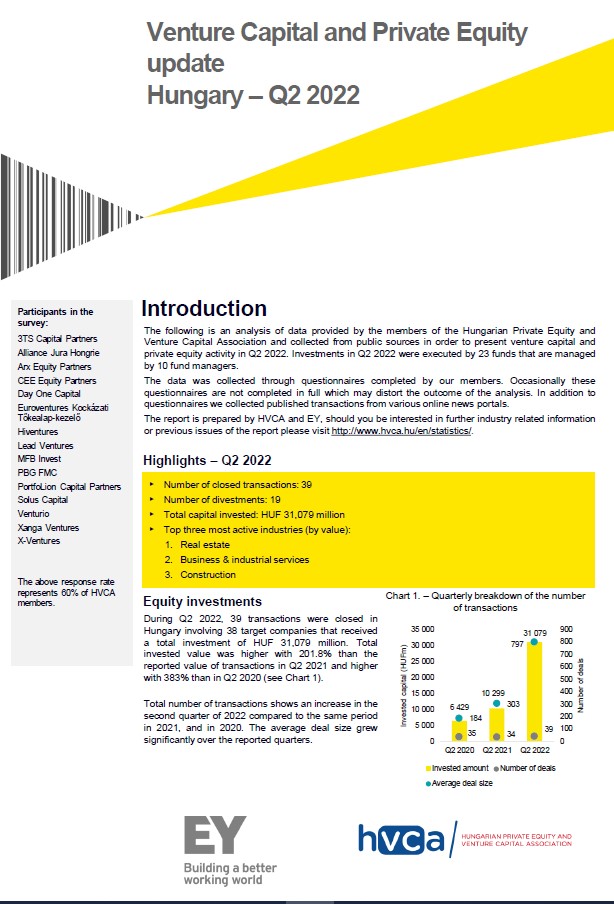

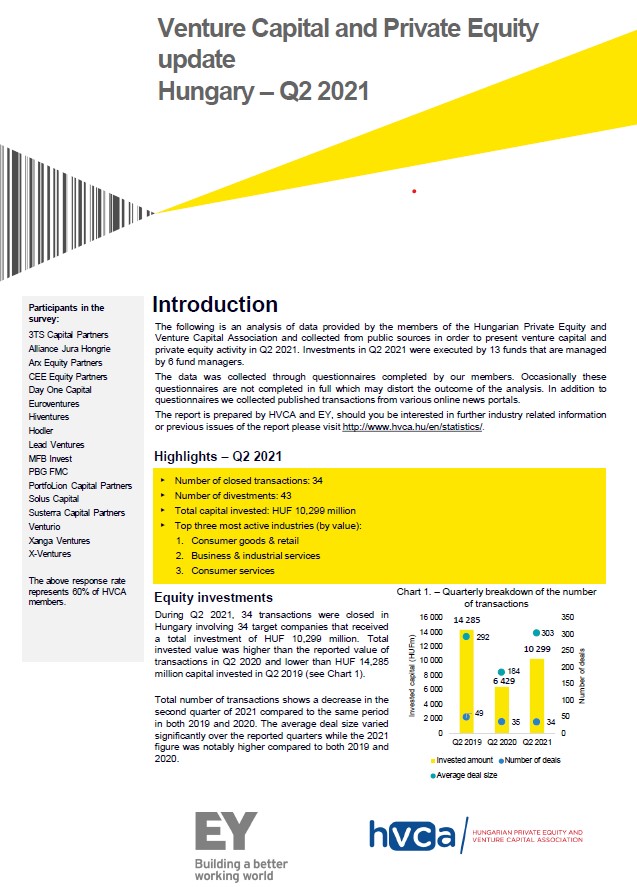

Investment monitoring riport Q2 2021

(360KB | pdf)Highlights - Q2 2021

Number of closed transactions: 34

Number of divestments: 43

Total capital invested: HUF 10.299 million

Top three most active industries (by value):

1. Consumer goods & retail

2. Business and industrial services

3. Consumer services

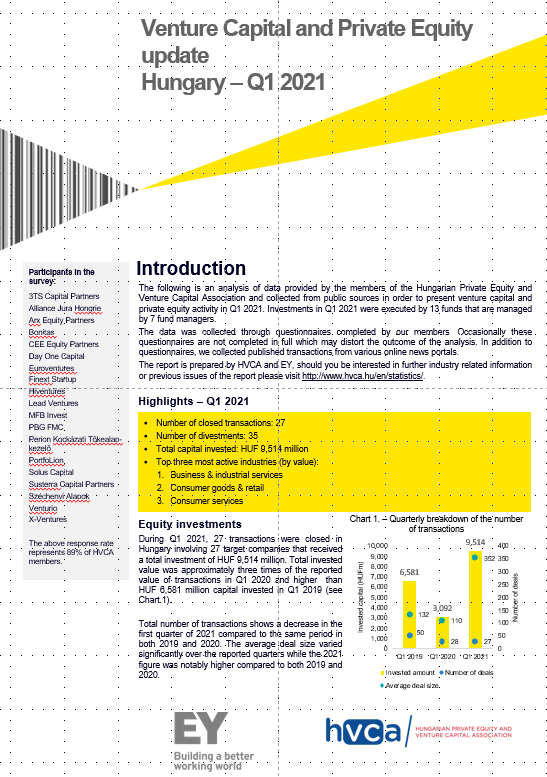

Investment Monitoring report Q1 2021

(358KB | pdf)Highlights: Q1 2021

Number of closed transactions: 27

Number of divestments: 35

Total capital invested: HUF 9,514 million

Top three most active industries (by value):

Business & industrial services

Consumer goods & retail

Consumer services

HVCA Statisztikák 2020

Investment Monitoring Riport Q3 2020

(275KB | pdf)Highlights – Q3 2020

• Number of closed transactions: 44

• Number of divestments: 17

• Total capital invested: HUF 9,956 million

• Top three most active industries (by value):

1. Business & industrial services

2. Business & industrial products

3. Transportation

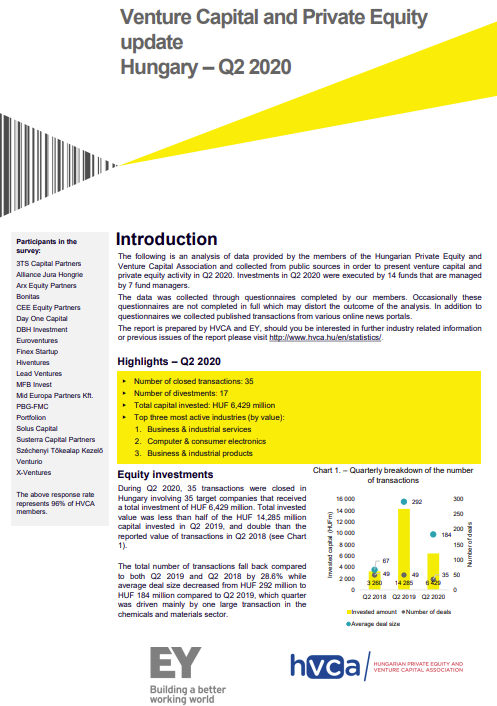

Investment Monitoring Report Q2 2020

(271KB | pdf)Highlights – Q2 2020

• Number of closed transactions: 35

• Number of divestments: 17

• Total capital invested: HUF 6,429 million

• Top three most active industries (by value):

1. Business & industrial services

2. Computer & consumer electronics

3. Business & industrial products

Investment Monitoring riport Q1 - Venture Capital and Private Equity update Hungary Q1 2020

(321KB | pdf)The following is an analysis of data provided by the members of the Hungarian Private Equity and Venture Capital Association and collected from public sources in order to present venture capital and private equity activity in Q1 2020 Investments in Q1 2020 were executed by 7 funds that are managed by 5 fund managers.

HVCA Statisztikák 2019

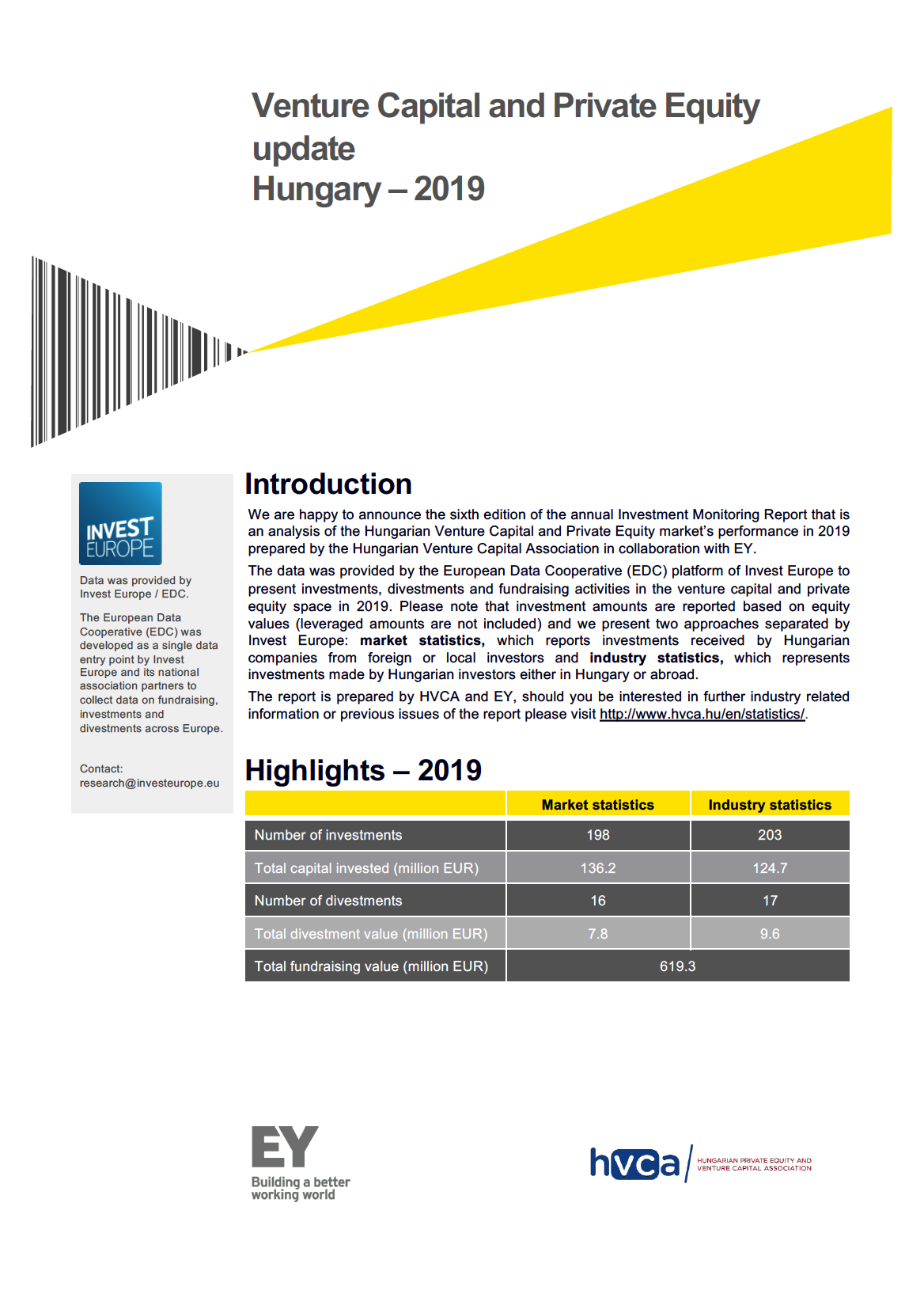

Investment Monitoring Report FY2019

(425KB | pdf)Higlights 2019

Number of investments: 198

Total capital invested (million EUR): 136

Number of divestments: 16

Total divestment value (million EUR): 7.8

Total Fundraising values (milliom EUR): 619.3

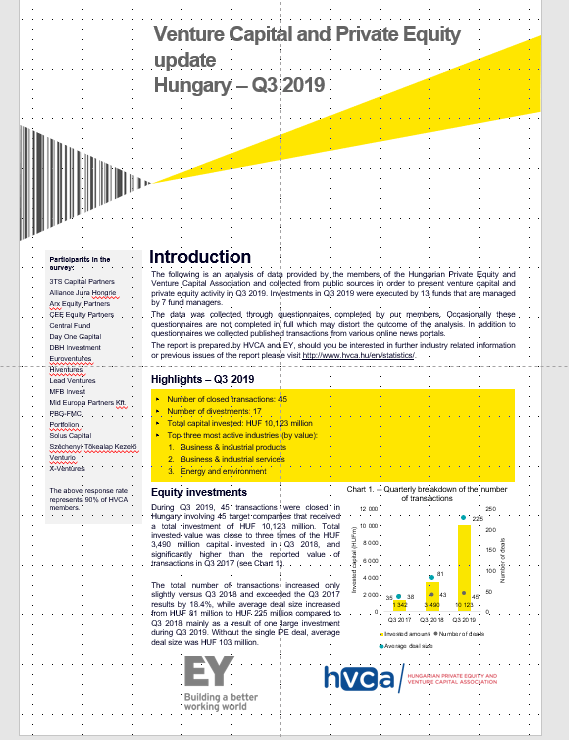

Investment Monitoring Report Q3 2019

(321KB | pdf)Introduction

The following is an analysis of data provided by the members of the Hungarian Private Equity and Venture Capital Association and collected from public sources in order to present venture capital and private equity activity in Q3 2019. Investments in Q3 2019 were executed by 13 funds that are managed by 7 fund managers.

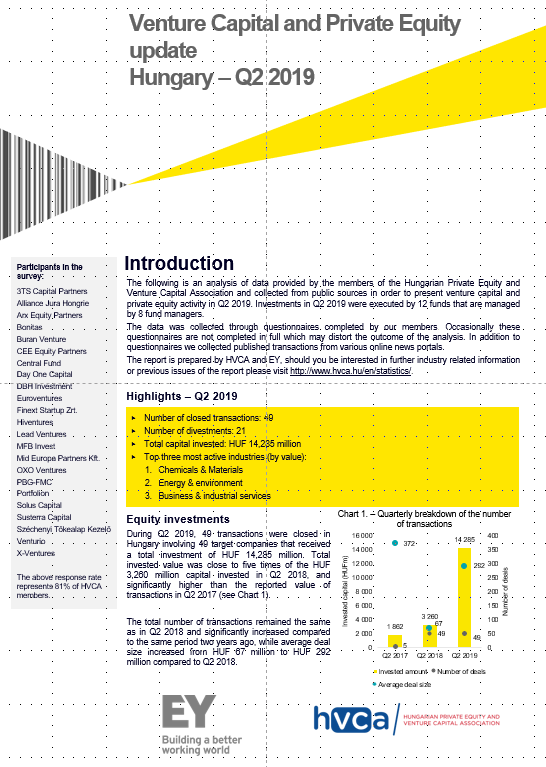

Investment Monitoring Riport Q2 2019

(285KB | pdf)The following is an analysis of data provided by the members of the Hungarian Private Equity and Venture Capital Association and collected from public sources in order to present venture capital and private equity activity in Q2 2019. Investments in Q2 2019 were executed by 12 funds that are managed by 8 fund managers.

Highlights Q2 2019

Number of closed transactions: 49

Number of divestments: 21

Total capital invested: HUF 14,285 million

Top three most active industries (by value):

Chemicals & Materials

Energy & environment

Business & industrial services

Investment Monitoring Report Q1 2019

(327KB | pdf)Highlights: Number of closed transactions: 50 (out of which, 46 were closed by VCs) • Number of divestments: 18 • Total capital invested: HUF 6,581 million • Top three most active industries (by value): 1. Business & industrial services 2. Financial services 3. Life sciences

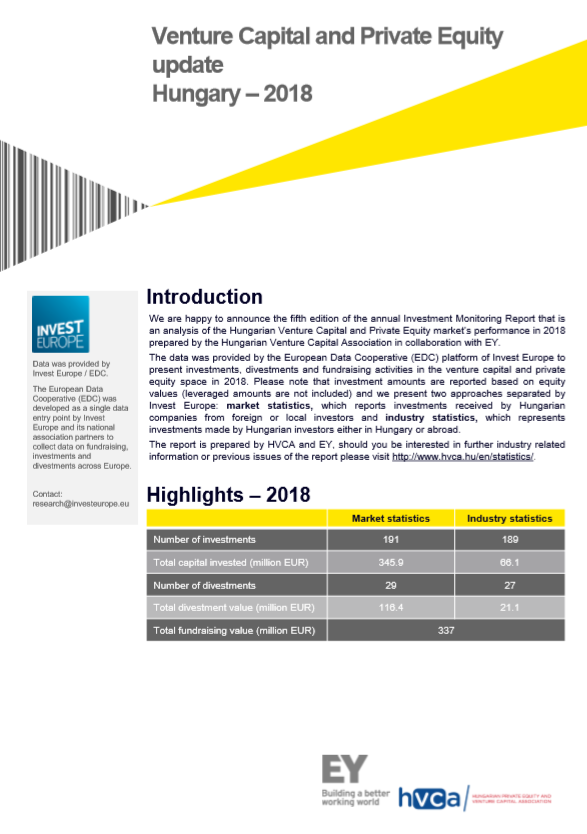

HVCA Statisztikák 2018

Investment Monitoring Report FY2018

(684KB | pdf)We are happy to announce the fifth edition of the annual Investment Monitoring Report that is an analysis of the Hungarian Venture Capital and Private Equity market’s performance in 2018 prepared by the Hungarian Venture Capital Association in collaboration with EY. The data was provided by the European Data Cooperative (EDC) platform of Invest Europe to present investments, divestments and fundraising activities in the venture capital and private equity space in 2018. Please note that investment amounts are reported based on equity values (leveraged amounts are not included) and we present two approaches separated by Invest Europe: market statistics, which reports investments received by Hungarian companies from foreign or local investors and industry statistics, which represents investments made by Hungarian investors either in Hungary or abroad

Investment Monitoring Report Q2 2018

(658KB | pdf)The following is an analysis of data provided by the members of the Hungarian Private Equity and Venture Capital Association and collected from public sources in order to present venture capital and private equity activity in Q2 2018. Investments in Q2 2018 were executed by 5 funds that are managed by 3 fund manager.

Investment Monitoring Report Q1 2018

(624KB | pdf)The following is an analysis of data provided by the members of the Hungarian Private Equity and Venture Capital Association and collected from public sources in order to present venture capital and private equity activity in Q1 2018. Investments in Q1 2018 were executed by 3 funds that are managed by 1 government related fund manager.

HVCA Statisztikák 2017

Investment Monitoring Report FY2017

(335KB | pdf)We are happy to announce the fourth edition of the annual Investment Monitoring Report that is an analysis of the Hungarian Venture Capital and Private Equity market’s performance in 2017 prepared by the Hungarian Venture Capital Association in collaboration with EY.

The data was provided by the European Data Cooperative (EDC) platform of Invest Europe to present investments, divestments and fundraising activities in the venture capital and private equity space in 2017.

HVCA Statisztikák 2016

HVCA Statisztikák 2015

HVCA Statisztikák 2014

Invest Europe Statisztikák

Investing in Europe: Private Equity Activity 2022

(4.4MB | pdf)Invest Europe - Annual activity statistics

Investing in Europe: Private Equity activity 2022- the most comprehensive and authoritative source of fundraising, investment, and divestment data, covering over 1,750 firms

2021 Central & Eastern Europe Private Equity Statistics

(1.1MB | pdf)Private equity invests in record 672 CEE companies in 2021

as new investment hits all time high.

• Private equity and venture capital invested €4.15 billion in equity in CEE companies in 2021, a new record for the region.

• 38.5% of capital was invested in the ICT segment.

Venture capital and growth investing drove the increase in investment levels:

• A record 541 companies receiving €659 million in VC funding.

• 90 businesses receiving €1.8 billion in growth investment, quadrupling 2020’s levels

Invest Europe - Private Equity Activity 2021

(3.7MB | pdf)Statistics on Fundraising, Investments & Divestments

Invest Europe - 2019 Central and Eastern Europe Private Equity Statistics

(1.4MB | pdf)This report was compiled with the help of Invest Europe’s Central and Eastern Europe Task Force It provides annual activity statistics for the private equity and venture capital markets of Central and Eastern Europe ( in 2019 and prior years

Investing in Europe - Private Equity Activity 2019

(4.3MB | pdf)Private equity’s mainstream position within the European economy must also yield an understanding and recognition of our critical role in safeguarding Europe’s long-term future…